Introduction

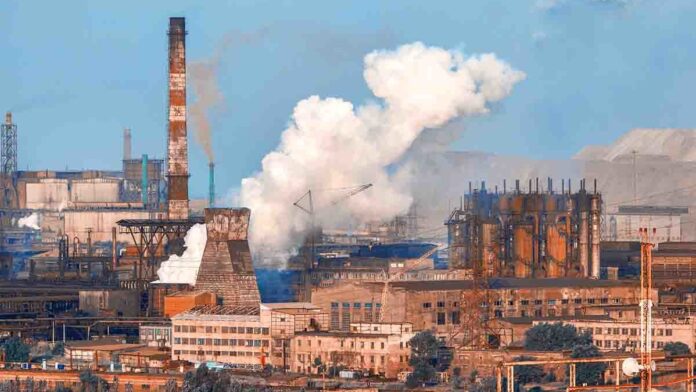

Pakistan’s industrial production has contracted by 1.87% in recent months, underscoring persistent challenges in the manufacturing and energy sectors. This decline highlights urgent systemic issues that threaten economic stability and growth. As analysts monitor the fallout, the need for targeted policy interventions to revive industrial activity has never been more critical.

Sectoral Breakdown: Causes of the Decline

- Manufacturing Woes:

- Energy Costs: Soaring electricity and gas tariffs have eroded profit margins, forcing factories to cut output. Industries like textiles, which contribute ~60% of exports, face liquidity crises.

- Circular Debt: A PKR 2.6 trillion energy-sector debt has led to power shortages, disrupting production cycles.

- Energy Sector Strains:

- Load-Shedding: Frequent outages in industrial zones (e.g., Faisalabad, Karachi) reduce operational efficiency.

- Dependence on Imports: Reliance on costly imported fuels exacerbates input costs, with global oil price volatility adding pressure.

- Global and Domestic Pressures:

- Export Slump: Reduced demand from key markets (EU, US) has hit textile exports, which fell 15% year-on-year.

- High Interest Rates: The State Bank’s policy rate of 22% stifles borrowing for capital investment.

Economic Implications

- GDP Growth: Industrial contraction risks lowering FY2023-24 GDP growth below the 2% target.

- Employment: The sector employs ~20% of Pakistan’s workforce; production cuts threaten layoffs in textiles, autos, and SMEs.

- Trade Deficit: Declining exports widen the current account gap, pressuring the rupee (down 25% since 2023) and forex reserves.

Policy Interventions: Pathways to Recovery

- Energy Sector Reforms:

- Fast-track renewable energy projects (solar, wind) to reduce import dependency.

- Resolve circular debt through tariff rationalization and subsidies for export industries.

- Industrial Incentives:

- Tax holidays for tech upgrades and export-oriented sectors.

- Public-private partnerships to modernize infrastructure (e.g., Special Economic Zones).

- Trade and Investment:

- Negotiate preferential trade agreements with emerging markets (Africa, ASEAN).

- Ease regulations to attract FDI in manufacturing and energy.

- Labor and Skills Development:

- Expand vocational training programs to address workforce skill gaps.

Analysts’ Watchlist

- Key Indicators: Upcoming GDP data, export figures, and inflation trends.

- Global Factors: China’s economic slowdown and shipping disruptions in the Red Sea.

- Political Stability: Clarity on long-term policies post-elections is vital for investor confidence.

Conclusion: A Pivotal Moment for Reform

Pakistan’s industrial downturn is a symptom of deeper structural flaws. Addressing energy inefficiencies, reducing bureaucratic hurdles, and fostering innovation are imperative to reignite growth. For a nation grappling with inflation and debt, industrial revival isn’t just economic policy—it’s a lifeline to stability.

ScaleUpPakistan.com Insight

Emerging economies like Pakistan must prioritize sustainable industrialization to compete globally. Strategic reforms today can transform challenges into opportunities, ensuring resilience against future shocks.